TAM SAM SOM Explained From The Investor’s Point Of View

As any early-stage Venture Capitalist will tell you, the quality of the team and the size of the market are the two most significant investment decision parameters. VCs need an airtight TAM SAM SOM analysis of your market in the pitch deck to validate initial interest.

However, many fundraising Founders struggle with the TAM SAM SOM pitch deck page, especially when they are raising Seed funding for their startup. At best, they reproduce some version of the Airbnb pitch deck but fail to answer the key questions Venture Capitalists are asking.

What are VCs looking for in the TAM SAM SOM analysis?

I’ve been helping and challenging Founders raising Venture Capital and Growth Equity funding on their TAM SAM SOM pitch deck page for over a decade and picked up a couple of best practices along the way.

In This Post

What Does TAM SAM SOM Mean?

Simply put, it is the way Investors look at your startup’s market opportunity. They are trying to assess whether you will make it big or remain small due to the limited size of your niche segment of the market.

So what do the acronyms stand for? Although there seems to be some disagreement, here are the most commonly accepted versions:

- TAM = Total Available Market

- SAM = Serviceable Available Market

- SOM = Serviceable Obtainable Market

Think of it as a target: TAM is the larger periphery, while SOM is the bull’s eye.

Let’s Take An Example

If you are developing an app helping drivers locate available parking slots, then TAM are all the drivers in the world.

SAM are the drivers in the areas you are servicing, i.e., the cities for which you have information on parking availability.

SOM is the share of that market you will eventually capture, taking into account market structure (you may not have information on all the parking spaces in town), competition, and customer usage (some drivers may not use public parking slots).

How Large Should Your Target Market Be?

It may seem an odd question given what I mentioned before: Venture Capitalists look for startup playing in large markets. The underlying reasoning is that you are more likely to build a large company in a large market. And large companies mean large returns for Venture Capital firms, who are in the game for outsized returns.

Our objective always was to build big companies. If you don’t attack a big market, it’s highly unlikely you’re ever going to build a big company.

Don Valentine (Sequoia Capital). Source: Stanford GSB

Many Founders raising early rounds (Seed or Series A) make at least one of the two following mistakes when they put together their TAM SAM SOM pitch deck page:

- Their TAM is too small, which is a non-starter for Venture Capital firms

- Their SAM is too large, which shows they don’t really know the market’s structure and dynamics

Going through hundreds of pitch decks as an Investor, Advisor, and Mentor has taught me one valuable lesson: when Founders are told what Venture Capitalists are looking for in the pitch deck, they become much more efficient.

In the second part of this post, I will take you inside the VC mind and tell you the objective of each of the TAM vs. SAM vs. SOM parts of the analysis.

Show Investors You Have A Unique Market Insight: SAM

Let’s start with the middle. Calculating a SAM that makes sense will prove to Investors that you possess a unique market insight that will make your team win – which, in early-stage Venture Capitalist’s parlance, translates into getting to product-market fit rapidly.

In extreme cases, that insight is what transforms a crazy idea into a $100 billion company.

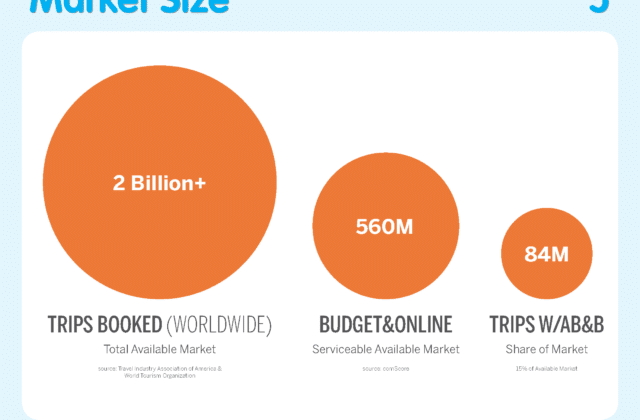

Take the AirBnB example. As we know from co-Founder Brian Chesky’s post and the email exchange between Y Combinator’s Paul Graham and VC Hall-of-Famer Fred Wilson, the idea was a tough sell. So how did Chesky & Co. convince elite Venture Capital firm Sequoia Capital to put the Seed funding?

As you can see from the Airbnb Seed Round pitch deck reproduced at the top of this post, the Founding Team was able to show that there was a sizeable budget & online segment within the huge travel market. (Note that Airbnb showed its market in terms of numbers of trips, not dollars, for reasons I’d be glad to address in the Comments section to this post.)

In other terms, they had a unique insight on the most promising market segment they should go after.

Communicate Your Go-To-Market Strategy: SOM

Once your SAM is clear, you need to focus on how you will target that market segment. This is where your SOM comes in.

My advice here is to show your 3-year or 5-year revenue in your SOM.

It will convey two key messages to the Investor reading your pitch deck for the first time, without you being around to comment it (which, incidentally, is how most pitch decks are used: the objective is to convince the VC he or she should take a meeting with you):

- Is your mid-term revenue objective large enough (see Valentine’s quote above)

- What is the first step in your go-to-market strategy, i.e., how you’ll address the identified target market segment (direct vs. indirect, via strategic partnerships, etc.)

Refining Your SOM: Illustration

Let’s take a very concrete example to show how your SAM and your SOM interact to convince Investors you’re on the right track.

I recently mentored one of our Funding Accelerator members on his fundraising strategy, starting with the pitch deck. The Founder, a serial entrepreneur based in the U.S., had just launched a mobile app to help U.S. consumers pay off their loans faster.

His TAM was huge: the U.S. Consumer Debt is close to $15 trillion dollars. But when we moved on to his SAM, things started to get vague. He still showed very large numbers, mostly because he hadn’t yet decided which market segment to tackle first.

After a few weeks of intense strategizing and a couple of mentoring sessions, he decided he would go after student loans first, which represents about 10% of the total consumer debt. Given the nature of his solution (which I purposefully don’t want to divulge too much in detail here), it was clear that students and recent graduates were the most promising segment – as opposed to housing debtors, which was his initial focus. The SAM became clear, but it still was very large.

Defining his SAM made it easier for our entrepreneur to build his SOM: he got in touch with a dozen recent graduates and asked them about their needs. He also proceeded to dissect student loans in detail. It helped him come up with his SOM: he would focus on a specific target (both in terms of genders and average amount of student debt balance) because he knew he could get to this group fastest.

After finding product-market fit with this first target (SOM), he would expand to other groups (SAM).

I hope it’s becoming clear for you why the TAM SAM SOM page of your pitch deck matters so much for Venture Capitalists. It is a concise way to introduce your go-to-market strategy while demonstrating that you have a unique perspective on your target market.

At this point in my training sessions, I usually get challenged by Founders.

Their SOM, which in this case is their 3-year to 5-year revenue, generally amounts to a few dozen million dollars at best. They ask me: “But you just told us VCs want to invest in startups with potential exit valuations in the hundred million dollars and more. How do we show them that we can grow that big?”

That’s where the TAM comes in. That number, and more importantly the nature of the market segment you chose to attack, is the horizon line. If your TAM is defined correctly, VCs will quickly realize that your market opportunity is huge, provided you take the correct route to get to your fist customers then target larger circles (SOM, then SAM).

I don’t know how to write a business plan, but I know how to read them. You start at the back, and if the numbers are big, we look at the front.

Tom Perkins (Kleiner Perkins). Read more about this quote.

In the example I took before, it is quite easy to imagine that if our debt-focused entrepreneur succeeds in the student loan market, he has a shot at spilling over to other segments. Auto loans are almost as large as student loans, and then there’s the housing market: mortgages total over $10 trillion in the U.S. If he could crack the student loan segment, and apply those recipes elsewhere, his startup could become large indeed.

Showing a meaningful TAM goes a long way to share your vision about where your company will be in ten or fifteen years. If this timeline seems long, think of the following:

- Early-stage investors routinely stay committed to a startup for seven to ten years before exiting

- At that point, any potential acquirer (or the financial markets in the case of an I.P.O.) need to have at least a five-year growth plan to be comfortable paying a large valuation

Having a vision of where your company could be in fifteen years is, therefore, quite meaningful for the conversation. The TAM vehiculates that vision best.

TAM vs. SAM: How Markets Grow

In the previous example, I took a “spill-over” growth pattern: if you succeed in one segment, you attack the next one.

In some example, the SAM grows by transfer from the TAM. Let’s go back to the Airbnb pitch deck mentioned above.

Although their TAM (trips booked worldwide) is forecasted to increase over time – a combination of demographics and growing middle classes -, no doubt the appealing factor for the startup is that their SAM willl increase by “cannibalizing” their TAM. In the context of the 2008 economic crisis, budget & online trips booked was bound to increase at a much faster rate, even in some cases offsetting a decrease in other market segments. The counter-cyclical nature of the business had a strong appeal with VCs.

Selling your vision by articulating a correct TAM and how it will impact your SAM is one of the most crucial demonstrations you need to make when engaging with Investors.

Beachhead: An Alternative Way

“One more thing”, as Inspector Columbo would say before delivering a damning message to his target. In this post, I’ve tried to debunk the TAM SAM SOM methodology into pieces and focus on a helpful way of using the framework.

As you can notice, I’m advocating for a bottom-up approach first (SOM then SAM), confirmed by a top-down check (TAM).

Some investors have vocally—and often convincingly—opposed TAM SAM SOM as Founders use this framework. They advocate a bottom-up strategy called the “beachhead” approach. The idea is to identify the most promising market segment, then gradually move to other groups of potential customers.

It’s a better way to address new markets.

2 comments

Hi Aram: You know I think TAM SAM SOM slides are almost always delusional and generally hurt the entrepreneurs credibility (and I appreciate your referencing my “Stop the Madness” blog), but I know that lots of MBA VCs ask entrepreneurs for their TAM, and so it makes sense to teach entrepreneurs how to do it right. Your point about “unique insight” is key. So, for example, if you are developing a parking app, your TAM is not “all drivers.” Your TAM is drivers who sometimes experience difficulty finding a parking spot. Okay, so what? That number does not matter at all. What matters is showing that you really understand who are the drivers who are desperate for this app. That defines your go to market strategy. Your point on student debt is good, but still too broad. We want to know that the entrepreneur really understands which student loan debtors are most desperate for the service, and how the entrepreneur can reach them and convert them with pinpoint accuracy and efficiency. For more, check out “Sizing Your Market Opportunity” …

https://www.linkedin.com/pulse/sizing-your-market-opportunity-bill-reichert-1c/

Hey Bill, thank you for the meaningful comment, looking forward to our chat on that subject! What I attempted to do in this post is reconcile both views: doing a TAM SAM SOM page that clarifies the go-to-market strategy and the first customer segment being targeted (à la beachhead). I’ll keep working on it, thanks for the guidance.